Council divests from Shell and BP

A sketch from the inner sanctum of North Yorkshire Council's pension sub-committee of

Proving that tenacity is a campaigning superpower, two members of Fossil Free North Yorkshire (FFNY) received some surprise news last week.

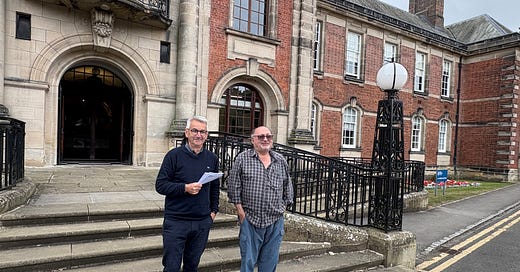

Armed with a bundle of papers containing their questions for what could well be the least reported of the many sub-committees which gather in County Hall, I accompanied campaigners Richard Tassell and Howard Green on their quarterly quest.

Members of FFNY have been taking the steps up inside the grand corridors of Northallerton’s fine 17th century building to dryly read out questions about the pensions invested for the benefit of council employees for more than four years.

The format is always the same - questions have to be submitted in writing a week in advance, the campaigners are allowed to speak only to ask the pre-prepared questions. The council, equally dryly, reads out an answer.

This all takes approximately 10 minutes before the campaigners take their long journeys back to which ever part of the county they’ve travelled from. Painfully bureaucratic it maybe but pointless? Turns out - absolutely not!

The council’s representative stood up and read from his script on Friday morning:

“The Fund continues to hold shares in fossil fuel companies, but it is worth noting that shares in BP and Shell are no longer held. This is because the Committee recently decided to remove the allocation to UK equities from the investment strategy”

No fanfare, no press release but still, the council’s representative had revealed a major policy shift and one which represented the whiff of success for the campaigners.

Catching up with the group after the announcement, FFNY members Richard Tassell, Margaret Jackson, Barry White, Howard Green and Harriet Greenwood issued the following response:

“We welcome North Yorkshire's pension fund decision to disinvest all their remaining holdings from the fossil fuel companies Shell and BP. This action is a step forward in removing funding from all climate destroying companies nationally.

“We ask that the pension fund divest from all remaining fossil fuel investments and reinvest in sustainable and regional companies which support the health and well-being of our communities.”

Other questions posed at the meeting included the number of councillors and employees who’ve received climate training. The questions and the council responses are in full below.

FFNY wants to see the proportion of the £4.6bn North Yorkshire Council pension fund currently with oil companies, instead invested in renewables.

FFNY is part of a wider UK network of groups campaigning to persuade local government pension funds to divest from fossil fuels and reinvest in sustainable activities.

The campaign is focused on the North Yorkshire pension fund and the pool to which North Yorkshire pension fund belongs, Border to Coast Pension Partnership. North Yorkshire pension fund is worth £4.6 billion, of which it is estimated that 1.8% (just under £76 million), is still invested in the fossil fuel industry.

The transcript from the full Q&A

Richard’s Question

We commend the recent actions of BCPP to vote against the renewal of the Chair of BP, because of the company's reversal of their policy on increasing investment in renewables and instead increasing activities in prospecting and drilling for new oil and gas.

This action surely illustrates the limits of ‘engagement’ if the intention is to influence these companies to comply with the 2015 Paris Treaty?

Given also, there is now clear evidence of ‘share buy backs’ by, amongst others, Shell, in order to maintain their declining share value (Mark Campanale CEO of Carbon Tracker, in the podcast Outrage and Optimism: The End of Oil? Inside the hidden decline of Fossil Fuels) is it not time, given the failure of the engagement strategy, and evidence of the start of a declining market, for the pension committee to consider divesting their remaining investments in oil and gas?

Council’s Response

We have replied to similar questions in the past and have a similar reply to give this time.

We continue to believe that aiming to influence company behaviour through engagement is an appropriate and constructive approach, even if engagement does not always get the results we would like. Divestment would lose any influence we may have and would be likely to put shares in the hands of investors with little or no interest in this issue.

It is also worth saying the question implies a misunderstanding, as in the real world, fossil fuel production is driven by demand and not supply. This demand will only reduce as the supply from renewables and nuclear energy increases. Currently around 20% of the UK’s energy requirements are met by nuclear and renewables. The dependence on energy from fossil fuels is undeniable, but it is expected to gradually reduce. By 2050 energy from nuclear and renewables is forecast to meet 65% of the UK’s demand. Companies such as Shell and BP are major investors in renewable energy so will play a key role in this and are expected to gradually change from being primarily fossil fuel companies to primarily renewable energy companies. Our role as an investor must be to aim to influence company behaviour along this path.

The Fund continues to hold shares in fossil fuel companies, but it is worth noting that shares in BP and Shell are no longer held. This is because the Committee recently decided to remove the allocation to UK equities from the investment strategy.

Howard’s Question

The following statements are taken from the document: North Yorkshire Council Climate Change Strategy 2023-2030 available at https://www.northyorks.gov.uk/environment-and-neighbourhoods/climate-change/climate-change-strategy-2023-2030

Our climate change strategy sets out how we will respond to the climate emergency by:

reducing greenhouse gas emissions

preparing for the changing climate

supporting nature to thrive

We will work with partners to achieve the ambition to be a carbon negative region by 2040 and encourage residents, businesses and visitors to take climate responsible actions.

The Council aims to be carbon neutral by 2030 and will measure and report its progress annually.

A detailed decarbonisation programme will cover our buildings, fleet, and the goods and services we buy and how we use our assets to support nature.

Climate Responsible actions will be built into the Council’s governance and culture, training, impact assessments, officer groups, and regular progress reporting.

Our work will take place within a set of principles that ensure our climate change activity is fair, evidence-based, and represents good value. We will maximise the co-benefits of climate action to support a good quality of life and a greener, fairer, stronger economy.

In Section 10 d) Embedding climate change into ‘business as usual’:

To achieve our target, we must all make climate responsible decisions. All NYC employees will need to understand the causes and impacts of climate change and how their actions will contribute:

i. We have bespoke climate change awareness training that is available to all employees and Councillors, and this will continue to be promoted.

My question is in three parts.

1: Is the pension fund a partner of the council, if not what is it’s status?

2: How many members of the pension fund committee have had the climate change awareness training mentioned above?

3: The council as evidenced by this document is working towards CO 2 mitigation. Simultaneously it’s pension fund is investing in fossil fuel producing industries (estimated at £75.9M here https://divest.platformlondon.org/fund/north-yorkshire-pension-fund–), inevitably increasing global CO 2 – how does the committee justify this ‘institutional cognitive dissonance’?

Council’s Response

The Pension Fund is part of the Council and is not a separate legal entity. However, the Pension Fund is managed on a completely different basis and has different objectives, policies and strategies to the Council’s other arrangements.

This includes having its own policy on responsible investment and carbon neutral objectives, where the aim is to be carbon neutral by 2050 or sooner. It is therefore not an appropriate comparison.

The training referred to gives a basic level of understanding of the causes and effects of climate change and the actions individuals and organisations can take.

It does not cover investments. However, Pension Fund Committee members have had detailed training specific to investments, including consideration of different climate scenarios as part of the recent review of the investment strategy. Climate change is also discussed at every Committee meeting.